The First-Time Home Buyer Incentive helps qualified first-time homebuyers reduce their monthly mortgage carrying costs without adding to their financial burdens. Click on above link to find out more.

First Time Home Buyers

Discover answers to common mortgage questions and explore expert tips on financing, refinancing, and buying your dream home.

The First-Time Home Buyer Incentive helps qualified first-time homebuyers reduce their monthly mortgage carrying costs without adding to their financial burdens. Click on above link to find out more.

Mortgages are like vehicles. A bank is similar to the brand, Ford or Toyota for example. How long you have a mortgage before it’s time to renew is like the model, a Fusion or Camry. The rate is similar to the car’s paint color, and the mortgage benefits such as prepayment privileges and portability are like the car’s benefits; 4-wheel drive, hatchback, four doors instead of two, etc.

A bank is like a sales person at a Ford or Toyota dealership. He or she know everything about every car on their lot; engine size, warranty, all available colors, and their fuel ratings. He or she can match any car to your needs and lifestyle, as long as it’s sold at their lot.

But what if they don’t have the most fuel efficient car? What if you don’t like the design or you need four doors and a trunk and all they have is two doors and a hatchback? Are you still going to buy from that dealership just because you went there first? No, you’re going down the street to check out the Chevrolet, maybe even BMW, Mazda, or the new Chrysler dealership. That sales person doesn’t want you to go buy from another lot down the street, but you are buying to satisfy your needs, not the dealership’s needs of selling their own cars.

Now imagine a dealership that sold every single make and model of vehicle. Imagine you could choose one of their sales people, and have them work only for you. They know just as much or even more about every make and model, they do all the research for you and tell you what you need to look for, they ask you the important questions; they have your best interest. That is a mortgage broker, your own personal expert.

Now, you may not need a personal expert to buy a car. But what about mortgages? Is a 0.10% lower interest rate a lot? Or will a 20% prepayment privilege instead of 10% be more advantageous? Can you switch lenders and move your mortgage? $15,000 or $5,000 penalty? How is it calculated? Fixed or variable? Is a collateral charge good or bad? 2-year term or 5-year? Big bank or monoline lender? How about credit unions? The list goes on.

So, a bank or Dominion Lending Centres mortgage broker? Put it this way; would you buy from the first dealership you visit or hire an expert?

Source: Ryan Oake

Dominion Lending Centres – Accredited Mortgage Professional

Life can go sideways and that is a fact. Illness, divorce, death, longest recession in 30 years or whatever the cause is, before you know it you can find yourself with an awful credit rating and are unsure of what to do. These are the things we mortgage professionals wished you knew.

1. Even though a company has written off a debt, you still have to clear it up. You will be unable to get a mortgage in place until all outstanding debts show as settled with a balance of $0. That can happen through negotiations and payment directly with the company, through an orderly payment of debts or through bankruptcy. We would advise extreme caution when it comes to anyone promising they can rebuild your credit immediately for a price.

2. You need to re-establish your credit as soon as you can. The magical number in the mortgage universe is 2. You need to get two types of credit for two years with each a minimum balance of $2,000. The clock starts counting on the date of bankruptcy discharge or OPD settlement.

3. If there was a foreclosure in your past, you are going to have a very hard time getting a mortgage. No mainstream or near prime lenders will consider this type of an applicant anymore which would leave your only option a private lender where you will pay higher interest rates. If you think you are heading towards this, then call a mortgage professional ASAP. There are investors out there willing to buy you out and wait to turn a profit when the market turns. Alternately, you could work out a deficiency sale with your mortgage lender and/or mortgage insurer which will allow you to purchase in the future.

4. After a bankruptcy or OPD, you cannot have ANY late payments. Not a single one. The lenders will accept that you were hit with a life event but you have to prove it will not happen again. Even one late payment on your cell phone is reason for a decline. The onus is on you to show them it will never happen again.

5. You can purchase a home with 5% down after you have properly established your credit again. Make sure you have the two credit types reporting as above first of all. The next step is to save. You are going to need the 5% to put down plus be able to show you have 1.5% for the closing costs and then you should also have an additional 3.5% in savings to show you have a fallback position in case you are struck by life again. The lenders and mortgage insurers really like to see that.

So it will not be easy but it is possible and the sooner you start the sooner you can buy a new home. Call your Dominion Lending Centres mortgage professional today to get an action plan in place.

by Pam Pickkert

Every year since October 2008 it’s become more and more difficult to obtain a mortgage. The government claims to be casting a safety net over the Canadian housing industry via stiffer mortgage regulations. What do you need to know to help prepare yourself for a home purchase, refinance, debt consolidation, or even a simple renewal? Well the biggest item I cover on a daily basis is preparation.

It can take a client weeks or months to find the confidence to connect with a Mortgage Professional once they feel confident that they ready to obtain that next mortgage. Any Mortgage Professional worth their salt will be able to guide their clientele to prepare them properly for the mortgage.

Typically most people think they need to prepare themselves most for their first purchase, however preparing for each mortgage these days is more critical today than ever before. When Canadians finally make that call, they want a step by step process to solve their solutions in an easy manner, but are seldom prepared to proceed.

During my regular daily routine, I follow up with my clients with gentle reminders to send me the requested documentation list. Having done this for ten years, the process is quite similar for almost each individual even though the main list of documentation remains the same.

We all want to take short cuts to get to the finished product, but in the end, the banks and lenders have become governed so much so that the short cuts are almost non-existent therefore, preparing the proper document package is essential to an essential mortgage. As Arnold Schwarzenegger said recently in an interview I watched on Facebook, we need to stop taking and thinking about short cuts. There aren’t any to success.

What I’m getting at here is that when your Dominion Lending Centres Mortgage Professional provides you with a mortgage document checklist, please don’t take it for granted, please follow each and every step carefully.

In general, the most common documents required are dependent on what you do for work. So if you are an employee, then the most recent paystub, and an updated employment letter along with the most recent two years of T-Slips (whether they are T4’s from employer’s, T5’s and pension slips), T1 Generals -the entire document (the documents your accountant prepares to submit to Canada Revenue Agency), Notice of Assessments (the form you receive back from CRA after your file is completed). Then there will be the verification of down payment via 90 days of bank statements, any mortgage statements, property tax assessments and the list can go one. The most common mistake is providing a mix and match of the above documents to try and piece together your income story. Depending on how your income is structured, we may be able to provide you with a near pre-qualification but lenders are being more adamant of having the documentation upfront, so that they are using their time, along with the mortgage insurer’s time. As a rule of thumb, the cleaner the file, the easier it is to underwrite and make a proper decision.

Common mistakes include, missing pages from tax documents, poorly written, unsigned, undated, missing info on employment letters (handwritten ones draw huge red flags), cut off pages from documents, out dated items(paystubs and employment letters over 30-60 days is pretty much null and void these days).

You may not know how to prepare yourself, but that’s also what we are for. We are essentially mortgage guidance counsellors to help prepare you for mortgage success, but if we are trying to obtain a mortgage via shortcuts, you’ll be upset with how the process goes.

We all used to have more leeway with mortgage documentation, but it’s clear the government is having banks and lenders scrutinize every mortgage more carefully now than ever before. And the banks and lenders have to oblige as they will be audited, if they don’t pass audits, then they lose out. And if they lose out, we lose competition. Yes this is the new normal, yes it’s tiring, no we don’t like it either, but it’s our new reality. And realistically, is gathering a few extra documents really that bad? Mortgages are not a given right and earned more so than ever before in our recent history.

Our job is to help you prepare for the mortgage, sometimes it will take one meeting, sometimes it’ll take weeks or months, even years depending on your own personal financial situation. But we can provide the recipe to help you prepare, but it’s up to you to do the cooking.

By Jean-Guy Turcotte

How is your credit score calculated? It is a complex answer and, as such, common myths persist. Today, we are going to help you get a better understanding of your credit score and how to make the grade by busting the most common credit score myths!

The reality is that cancelling healthy, active cards or accounts hurts more than having too many. When you cancel a card, all your payment history is lost as well as the type of credit granted. While you may think having a couple credit cards is extreme, the average Canadian has TEN credit sources. What many Canadians don’t realize is that lenders want to see a history of credit; they want to see payments made on time. In addition, lenders also want to see balances maintained at no more than 70% of your credit limit in use. So, if you have a $10,000 credit card, you don’t want to owe more than $7,000 on it at a time.

It is easy to think that different forms of credit matter more than others, but that is simply not the case. In fact, all lenders want to see is a history of credit and payments made on time. This is what will build your credit score and, eventually, give you the ability to qualify for financing. A history of on-time payments and manageable balances shows the lender that you are a promising investment and not likely to default.

Unfortunately, paying utilities does not build credit. In fact, these providers only check your credit score to determine creditworthiness; they don’t report your payment history to the bureau. Unless you are late to pay, that is. The other organizations that only report on default are municipalities and vehicle insurance providers, so make sure you keep these payments up-to-date. Be sure to pay any traffic tickets and bylaw infractions too!

Don’t be discouraged. Lenders understand that you are only human and, in many cases, they are often willing to work with you if there is a late payment. If they are notified within a timely manner, a late payment can be easily reversed. Just be careful not to make a habit of it.

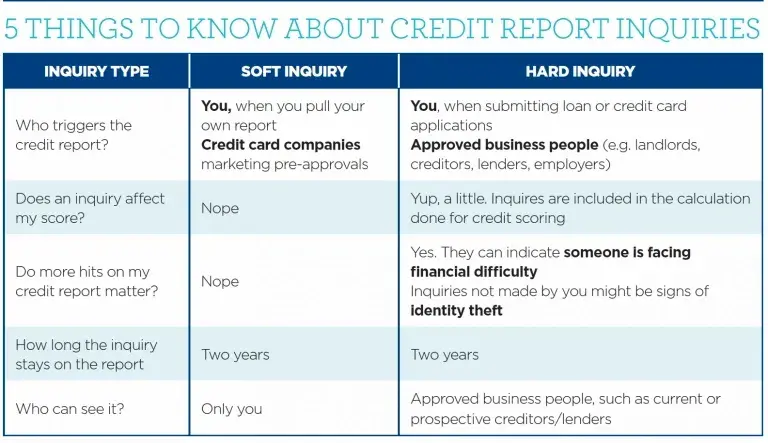

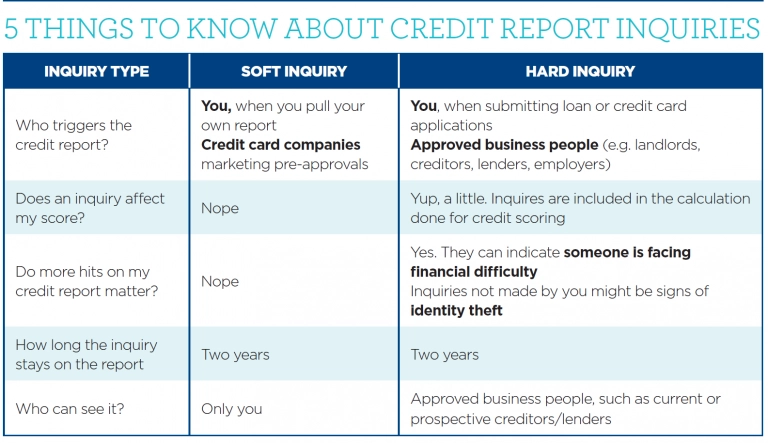

No exactly. There are two types of credit inquiries: soft and hard. A soft inquiry occurs when you pull your own credit report. Credit card companies also pull this type of inquiry when marketing pre-approval offers. Soft inquiries do not affect your credit score.

A hard inquiry, on the other hand, is triggered by the applicant when submitting a loan or credit card applications. As a result, hard inquiries will affect your credit score slightly as they are included in the calculation done. Recording the number of inquiries a consumer has on the credit report allows potential lenders to see how often a consumer has applied for new credit; this can be a precursor to someone facing credit difficulty. Too many inquiries could mean that a consumer is deeply in debt and is looking for loans or new credit cards to bail themselves out. Another reason for recording inquiries is for preventing identity theft. Hard inquiries that aren’t made by you could possibly be from a fraudster trying to open accounts in your name; therefore only individuals with a specific business purpose can check your score. Creditors, lenders, employers and landlords are some examples of approved business people. The inquiry only appears on the credit report that was checked.

In addition, hard inquiries remain on all credit reports for two years, after which they are removed. Soft inquiries only appear on the report that you request from the credit bureaus and will not be visible to potential creditors.

Credit score plays a vital role when it comes to potential financing for car loans, mortgages, or even personal loans. It is important to recognize good credit habits now and maintain them for a higher credit score today, and better chance of financial approval in the future.

Check out the best mortgage calculator on the market to help you determine your rates.

Though credit scores aren’t always an indicator of financial health, they are used in a variety of ways that could have a major impact on your life. Interest rates (including mortgage rates) are almost always determined by your credit score. Some employers & landlords may require a credit check to see if you have past credit issues.

Remember this is your credit report, not your “I’m Fiscally Responsible” report. Lenders want to know how you have historically handled credit in order to determine if you are a good credit risk. Higher risk = higher rates!

The Rule of Two:

• You should always have 2 “tradelines” going. This can be a combination of 2 credit cards OR a credit card and a line of credit/ loan etc.

• Credit lines should have a minimum $2,000 limit

• Minimum of 2 years old

So, if your credit score sucks, it could be costing you.

The good news is, you don’t have to live with bad credit forever. There are plenty of things you can do to improve your credit score. Use the 9½ tips below, to improve your credit score

Request a free copy of your credit report from both of Canada’s credit agencies (TransUnion and Equifax). You are legally entitled to one free credit report yearly from each credit agency. Check out my BLOG How to Get a FREE Copy of Your Credit Bureau

If you find any errors in your credit report, you should dispute them with Equifax or TransUnion and request to have them correct any errors.

This might seem obvious, but you need to make your payments on time, every time! This is crucial to repairing and maintaining your credit rating. The largest percentage of your credit score is based on your payment history!! Even being a couple of days late will have a negative impact on your score. Staying current with your payments has a huge positive impact. If you can’t pay the balance off in full, pay the minimum amount on time!

Going over your credit limit, even once will have a huge negative impact on your credit score. You need to be aware of your credit limit and your current debt levels to avoid this.

Paying off a collection account will not remove it from your credit report, so do your best to avoid going to collections. If you have any overdue accounts that have gone to collections, negotiate to pay them off ASAP.

Easier said than done, but if you want to increase your credit rating, you need to reduce your debt. The closer you are to your credit limit, the lower your score. In a perfect world you only want to use about 30% of your available credit. If you have a lot of credit card debt you might consider a loan (with lower interest rates than the credit cards) to consolidate your debts.

You lose points from excessive hard inquiries on your credit bureau. Any attempts to take on multiple loans/credit cards will look bad in your report.

Account age is a factor that reflects positively on your credit score. Too many new accounts lowers your average account age and negatively impacts your credit score. For the same reason, you may want to keep an old account open, even if you are not actively using it.

When rebuilding your credit, time will be your best friend. The impact of past credit problems lessens with time, so that a late payment from a year ago will have much less weight than a late payment today. Get current and stay current.

As more of our personal information gets circulated via the internet, there’s more room for “bad people” to steal your personal details so that they can make fraudulent purchases in your name. This can be extremely damaging to your credit history. You can protect your credit history from this by paying for a service that can alert you to fraud.

If you have any questions, contact a Dominion Lending Centres mortgage broker near you.

by Kelly Hudson

Did you know that 60 per cent of people break their mortgage before their mortgage term matures?

Most homeowners are blissfully unaware that when you break your mortgage with your lender, you will incur penalties and those penalties can be painfully expensive.

Many homeowners are so focused on the rate that they are ignorant about the terms of their mortgage.

Is it sensible to save $15/month on a lower interest rate only to find out that, two years down the road you need to break your mortgage and that “safe” 5-year fixed rate could cost you over $20,000 in penalties?

There are a variety of different mortgage choices available. Knowing my 9 reasons for a possible break in your mortgage might help you avoid them (and those troublesome penalties)!

9 reasons why people break their mortgages:

1. Sale and purchase of a home

• If you are considering moving within the next 5 years you need to consider a portable mortgage.

• Not all of mortgages are portable. Some lenders avoid portable mortgages by giving a slightly lower interest rate.

• Please note: when you port a mortgage, you will need to re-qualify to ensure you can afford the “ported” mortgage based on your current income and any the current mortgage rules.

2. To take equity out

• In the last 3 years many home owners (especially in Vancouver & Toronto) have seen a huge increase in their home values. Some home owners will want to take out the available equity from their homes for investment purposes, such as buying a rental property.

3. To pay off debt

• Life happens, and you may have accumulated some debt. By rolling your debts into your mortgage, you can pay off the debts over a long period of time at a much lower interest rate than credit cards. Now that you are no longer paying the high interest rates on credit cards, it gives you the opportunity to get your finances in order.

4. Cohabitation & marriage & children

• You and your partner decide it’s time to live together… you both have a home and can’t afford to keep both homes, or you both have a no rental clause. The reality is that you have one home too many and may need to sell one of the homes.

• You’re bursting at the seams in your 1-bedroom condo with baby #2 on the way.

5. Relationship/marriage break up

• 43% of Canadian marriages are now expected to end in divorce. When a couple separates, typically the equity in the home will be split between both parties.

• If one partner wants to buy out the other partner, they will need to refinance the home

6. Health challenges & life circumstances

• Major life events such as illness, unemployment, death of a partner (or someone on title), etc. may require the home to be refinanced or even sold.

7. Remove a person from Title

• 20% of parents help their children purchase a home. Once the kids are financially secure and can qualify on their own, many parents want to be removed from Title.

o Some lenders allow parents to be removed from Title with an administration fee & legal fees.

o Other lenders say that changing the people on Title equates to breaking your mortgage – yup… there will be penalties.

8. To save money, with a lower interest rate

• Mortgage interest rates may be lower now than when you originally got your mortgage.

• Work with your mortgage broker to crunch the numbers to see if it’s worthwhile to break your mortgage for the lower interest rate.

9. Pay the mortgage off before the maturity date

• YIPEE – you’ve won the lottery, got an inheritance, scored the world’s best job or some other windfall of cash!! Some people will have the funds to pay off their mortgage early.

• With a good mortgage, you should be able to pay off your mortgage in 5 years, there by avoiding penalties.

Some of these 9 reasons are avoidable, others are not…

Mortgages are complicated… Therefore, you need a mortgage expert!

Give a Dominion Lending Centres mortgage specialist a call and let’s discuss the best mortgage for you, not your bank!

By Kelly Hudson

You may have heard that rates are changing, and that is true. They don’t call it war for nothing and you need an expert by your side!

Think of mortgage brokers as your loyal soldiers. What we are seeing is exactly what we anticipated when prime rate goes up and discounts go down. Confused? Don’t be, variable rates are based on prime and both Bank of Canada Prime and Bank Prime are different.

What the new discount means is what it means – they anticipate prime to go up higher.

With current regulations, borrowers qualify for more mortgages on a variable rates! This is a shift from the previous policy where more Canadians were having to take fixed rates to qualify for the most.

These new discounts on new mortgages getting taken out there discount is lower off of the bank’s prime rate- this does not apply to an existing mortgage

Did you notice earlier I said the bank’s prime rate, you would think they are all the same… right?

This is not the case. In November of 2016 one Canadian lender broke the trend of their counterparts and raised their internal prime to immediately impact their existing customers by adding to their amortization. This discount below was for new clients they increased the discount so it looked bigger.

Lender who broke the trend prime Other lenders prime

3.65% 3.45%

Discount 1.15 Discount ranging from 1.06=.95%

It’s important to note – each lender has unique criteria to be met to get these offers: some only for purchases, some only with switches, some only certain amortizations, and some only certain property types. The list goes on!

Remember your broker shops all these lenders without bias, while protecting your credit score to assist you in finding the best one. It’s important that we evaluate the following criteria with these lenders- here is an example of three lenders:

Lender one

Bank has a higher Prime than anyone else

No change to payment

Increases amortization which can put into effect a trigger clause- cash call in on mortgage or forced pre-payment and other costs such as appraisal at your expense

Not portable

Does have a 12 month penalty payback if getting a larger mortgage at new rates! Best one!

Have to go to branch to lock in and then be subject to their IRD (usually 3-5% of balance pending where you are in your term).

Based on history this lender is generally the first to raise their rates and last to decrease

Lender two

Prime rate consistent with all lenders

Change to payment so amortization doesn’t increase

NO trigger clause

Have to go to branch to lock in and face large IRD between 3-5%

Not portable but will refund you within 6 months if the mortgage is larger and will get rate available at that time

Lender three

Prime consistent with all lenders

Change to payment so amortization doesn’t increase

NO trigger clause

lender will pay back penalty within 3 months of getting a larger mortgage with them

your mortgage expert can assist you with lock in

If you lock in they have the lowest penalties in the country to break your mortgage in the future, generally 1-1.5% of the balance

With seven-in-10 mortgages breaking before the term is over, this should be weighted very carefully.

Let me demonstrate the following:

A mortgage that gets locked in with first or second lender above at $500,000, by the third year the cost to break a mortgage will be between $15,000 and $25,000. With the third lender the cost would be between $5,000 and $7,500.

What to do with this info?

These new wars apply to new mortgages. If you have a mortgage with a discount less than .50, a renewal upcoming, looking at accessing your equity for home renovations or to consolidate debt and you have a variable rate, it may be time to run the numbers to see if taking a new variable rate mortgage is beneficial for you. One of the significant benefits of having a VRM is to get out at any time with only three months interest penalty (unless a restrictive product was taken for a better rate or had a sale only clause).

As you can see we have only scratched the surface in terms of the differences. There are many other differences and mainly you have to consider as a consumer, do you want to be calling a bank branch and play Russian roulette with the education level and sales goals of the person who guides you through deciding what to do with your biggest asset? Or would you rather have a Dominion Lending Centres mortgage professional who is in the front lines proactively guiding you and assessing the economic factors to give you personalized advice based on their experience and knowledge of the mortgage industry.

Depends on what you value most!

Source: Angela Calla

FIRST TIME HOMEBUYERS PROGRAM (new as of January 16, 2017)

As of January 16, 2017 the provincial government has introduced the B.C. Home Owner Mortgage and Equity Partnership program for First-Time Homebuyers needing help with their down payment.

Eligibility requirements for the new government first-time homebuyer down-payment loan program are:

• Have saved a down payment amount at least equal to the loan amount for which they are applying from government.

• Have been a Canadian citizen or permanent resident for at least five years.

• Have lived in B.C. for at least one year prior to the sale.

• Be a first-time buyer who has not owned an interest in any residential property anywhere in the world at any time.

• The home must have a purchase price of less than $750,000.

• The buyer must already be able to qualify for an insured high-ratio first mortgage for at least 80 per cent of the purchase price.

• The combined gross household income of all people on title must not be more than $150,000.

Applications are open for 3 years starting January 16, 2017 and ending March 31, 2020. For more information check out the link below:

https://housingaction.gov.bc.ca/tile/home-owner-mortgage-and-equity-partnership/

CHIP is a reverse mortgage that let’s seniors unlock the value in their home without having to sell or move. If you’re 55+ and looking for extra money to do important home improvements or meet day-to-day expenses, a reverse mortgage could be a solution for you. Turn up to 50% of your home equity into cash!

The money you receive is tax-free and yours to use as you wish. You can take it all as a lump sum or receive monthly payments. Best of all, you don’t have to make any payments at all until you move or sell!

– pay off debts

– pay unexpected medical expenses

– improve your home

– help your children or grandchildren

– travel

– improve your day-to-day standard of living

“Live a better retirement”

For a free quote, please call Antonietta Gaudet, CRMS, at (250) 218-2184 (call or text)

For more info please visit http://www.lowest-rates.ca/chip

People fear what they don't understand. A good example is the purchase of a home. The average consumer knows very little regarding the home buying process. Between finding the right house, making sure it won't fall apart the day after it is purchased, and finding the best financing, it is no wonder that so many people are afraid to purchase homes.

Buying a home is one of the most important financial decisions an individual will make. For a first-time homebuyer, the decision to purchase a home can be daunting. It will represent a major step forward as the individual/family will be assuming potentially its largest responsibility. As with any major decision, it is important that everyone, especially first-time homebuyers, take full advantage of the information and training that is available to more clearly understand the home buying process.

To prepare, you should do research and be fully informed before beginning the search for a dream home. Here are six steps to get started:

STEP 1: Before you start your house search, think carefully about what it will be like to be a homeowner. For most people, homeownership can be one of the most significant financial turning points in their lives. The advantages (tax benefits, pride of homeownership, financial investment) far outweigh any drawbacks.

STEP 2: Your credit history is one of the first things a lender will look at in making a decision on your loan. Visit www.equifax.ca to obtain a credit report. Review it carefully to be sure all the information is correct. If you find discrepancies, you should work with the credit agencies to resolve them.

STEP 3: Saving for a down payment can be one of the biggest barriers to homeownership. Mortgage lenders recognize this dilemma and many now offer low down payment loans. Five percent is usually the minimum requirement for a down payments.

STEP 4: Before you begin working with a realtor, find a mortgage broker you can trust and ask them to pre-approve (not prequalify) you for a mortgage. Getting a pre-approval is easy. You just call a mortgage broker, provide some basic financial information, ie. documentation to confirm your employment, the source of your down payment and other aspects of your financial circumstances.

Most lenders will provide this service free of charge. Pre-approval will let you know exactly how much you can spend on a home purchase BEFORE you start your search. A preapproval in hand also makes you a more attractive buyer when you are ready to make an offer on a home. Home sellers are more likely to accept an offer from a buyer who can demonstrate the ability to secure financing.

STEP 5: Many mortgage lenders, nonprofits, and even realtors offer homebuyer education guides to prepare you for homeownership. Some of the topics covered are how to apply for a loan, find the right realtor, make an offer on a home, and the advantages and responsibilities of homeownership.

STEP 6: The mortgage broker vs. banks and mortgage companies. A mortgage broker has many different banks, savings and loan companies and mortgage companies that they "broker" their loans to, something like a stockbroker or independent insurance agent.

Since a mortgage broker does business with lots of banks throughout Canada, they can:

Send the loan to many different underwriters

Shop for the best rates and programs

Save you money by not charging loan origination fees

So, what's in it for you?

You can finds ways to get out of the "trap" of paying rent.

You are confident that you made the right decisions about your mortgage.

Nobody rushed you into the wrong mortgage program because you had to apply for your mortgage within 3 days of signing your purchase agreement.

Is 3 days long enough for you to make a decision that could last for 30 years?

Your desire to own a home, combined with my knowledge, will increase your chances dramatically.

Most banks want to "cherry pick" the easy ones.

Not me, because I have so many more options than they do.

Well, I hope I got you thinking.

You probably have some questions.

However, we guarantee that you can save thousands of dollars. Your time is precious too, so we won't waste that either.

We can give you a detailed analysis of how much you will save by owning instead of renting.

Please give me a call while this is fresh on your mind and you are excited about the possibilities.

Even if you are skeptical, which is only natural, a phone call can't hurt.

The worst that you will do is spend a few minutes learning.

The best you can do is have "peace of mind" and save yourself lots of money.

Or, if you wish, we can send a pre-approval package out to you today, or fax information to you.

What are you waiting for...give me a call and lets get started!

Antonietta Gaudet (250) 218-2184 (call or text)

Fill out an application today!

http://www.lowest-rates.ca/how-to-apply-mortgage

P.S. Think about it. Now is the time to escape from endless rent payments. We can mail you a Pre-Approval Kit to get you started on your road to homeownership today!

P.P.S. More people who are renters now qualify to become a homeowner. Don't let fear or ignorance stand in your way. Our job is to educate and advise you. Call us today to take one step closer toward realizing your dream of one day becoming a homeowner.

Originator Licence #500874

966 Shoppers Row

Campbell River, BC V9W 2C5